The foundation of establishing an effective financial plan begins with learning how to manage your money every month. The right monthly budgeting tips will help you stay organized with bills, save money, and aid in achieving your long-term financial goals. Many people are meeting, learning how to create a monthly budget for the first time, and wondering which methodology is the best fit for their lifestyle. With so many individuals budgeting these days, it is essential to establish a process you'll stay consistent & structured with, even if it is a rudimentary budgeting process and strategy. For most beginners, a simple monthly budgeting framework and process—learning how to track expenses every month—is integral to managing their costs and gaining a sense of control.

This simple guide presents you with simple, "realistic" monthly budgeting tips designed to allow anyone to establish and maintain a monthly budget regardless of income level!

Budgeting isn't about denial; it's about being prepared for financial freedom. A set monthly budget provides insight into how to spend your money each month:

Implementing tips on monthly budgeting helps you take control of your finances and not let them control you.

If you don't know how to put together a monthly budget, there are a few straightforward steps you can take to get started:

Please add up all the sources of income you receive each month, such as your job, freelance work, or any side gigs you do, to determine your total monthly income.

Write down all of your monthly expenditures, such as rent, grocery costs, streaming subscriptions, transportation, gas, etc.

Fixed costs are expenses that remain constant (e.g., rent, loan payments), while variable costs fluctuate from month to month (e.g., dining out, entertainment).

It is easier to stick to a budget when you have something specific to prepare for, such as managing your expenses, and also to acknowledge that you are budgeting.

It is better to start small rather than wait for the "perfect time." Over time, your best monthly budget plan will evolve as you progress.

The best monthly budget is the one that actually fits your life. There’s no magic formula for everyone, but a few tried-and-true methods can keep you on track:

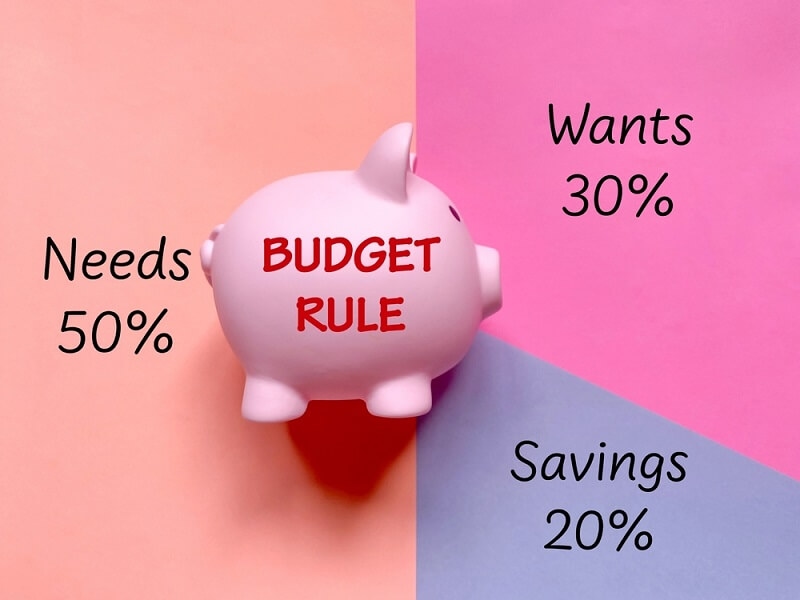

This one’s pretty straightforward. Half your money goes to the essentials—think rent, bills, and groceries. Then, 30% is for the fun stuff, like eating out or catching a movie. The last 20%? That’s for saving up or knocking out debt.

Here, every single dollar you earn goes to a job. You decide where your money goes, so when the month ends, you’ve got nothing left unaccounted for. Basically, income minus expenses equals zero.

This one’s old-school, but it works. You split your cash into envelopes labeled for specific expenses, such as gas, groceries, or dining out. When an envelope’s empty, you stop spending in that category until next month. You can use real envelopes or a budgeting app—whatever feels right.

All these methods help you see where your money’s going, without forcing you into a system that doesn’t fit your habits. The trick is sticking with the one that actually works for you.

Managing your budget each month doesn’t have to be a chore. In fact, it becomes much easier once you establish a routine to follow. Here’s how I’d approach it:

Stick with these habits, and, before long, they’ll become second nature. That’s when you’ll really notice your money management getting much stronger.

Learning how to track expenses monthly is one of the most critical steps toward better financial health. If you can’t measure your spending, you can’t manage it effectively.

Practical Expense Tracking Tips:

By tracking expenses diligently, you’ll notice where your money leaks occur and can make smarter financial decisions moving forward.

Don’t stress about getting your budget perfect right from the start. What works better? Set small, clear goals that you can actually achieve, such as saving a set amount every month or spending a little less on takeout.

Key Tips for Budgeting Beginners:

Ultimately, consistency prevails over complexity. You don’t need a perfect budget—you need one that’s real and doable.

No matter how carefully you plan your budget, mistakes can still occur. So, watch out for these common traps:

Messing up is part of the process. Each mistake is an opportunity to refine your approach and keep your goals within reach.

Sticking to a budget is easier said than done, but motivation plays a significant role in long-term success.

Here’s how to stay consistent:

Over time, these steps make budgeting less of a task and more of a lifestyle choice.

Once you’ve set your best monthly budgeting plan, it’s essential to monitor your progress. Reviewing helps you identify spending trends and make informed financial decisions.

You might notice that your grocery costs increase or entertainment spending spikes during certain months. By recognizing these patterns, you can refine your budget and align it more closely with your goals.

Regular reviews also strengthen your budget for beginners by turning good financial habits into lasting routines.

Applying practical monthly budgeting tips can completely transform your financial life. By learning how to start a monthly budget, building a simple budgeting system, and consistently tracking expenses, you set yourself up for economic stability and peace of mind. The key lies in commitment, awareness, and steady improvement over time.

This content was created by AI